Redundancy occurs when there is a termination of employment by an employer on specific grounds other than the employee’s performance issues or conduct related issues. Because of this, the ex-employee is entitled (in most cases) to redundancy pay.

Read on to learn about the legal entitlements that employees should receive when their employment is terminated by reason of redundancy. And if you have any further questions about redundancy pay, please contact our team of employment lawyers.

What is redundancy?

Redundancy occurs when employment is terminated because the job is no longer needed or because the employer becomes insolvent/bankrupt. It can also happen when the business:

- Introduces new technology that replaces someone’s job

- Goes through a restructure or merger and acquisition

- Relocates interstate or overseas

- Slows down because of lower sales or production

Learn more:

- Executive redundancy

- Difference between unfair dismissal and wrongful dismissal

- Terminating employees on workers compensation NSW

Redundancy vs unfair dismissal

For it to be considered a genuine redundancy, the termination of employment must meet the above criteria (i.e. your job is no longer needed or the business is insolvent/bankrupt). If your employment is terminated for any of the reasons below, it may actually be unfair dismissal:

- Your dismissal was harsh, unreasonable or unjust (i.e. without a valid reason, you weren’t notified of a reason or given an opportunity to respond to the reason).

- Any of the following:

- Race

- Religion

- Sex

- Age

- Marital status

- Disability

If you have been made redundant, but believe it is really unfair dismissal, you should speak to an unfair dismissal lawyer as soon as possible.

Learn more: genuine redundancy or unfair dismissal?

What is redundancy pay?

Redundancy pay is a payment made to an employee that has been made redundant. According to Section 119 of the Fair Work Act 2009 (the Act), an employee is entitled to receive redundancy pay if the employer terminates the employee’s employment due to:

- Their own initiative because the employer no longer requires the job to be done by anyone, excepting in case of ordinary and customary turnover of labour; or

- The employer becomes insolvent or bankrupt.

When it comes to redundancy law and redundancy entitlements, it’s important you are aware of your rights. If you have any questions or concerns, you will need to get into contact with one of our employee rights lawyers.

Note: From 1 January 2010, the National Employment Standards (NES) replaced the non-pay rate provision of the Australian Fair Pay and Conditions Standard.

How many weeks’ pay do you get for redundancy?

As per the NES, an employer must provide an employee with a minimum period of notice or payment in lieu of notice before terminating their employment. All employees working under Commonwealth workplace laws are entitled to redundancy payments or severance payments up to a maximum of 16 weeks’ pay under the NES if:

- They have at least 12 months of continuous service; and

- They are working for an employer that employs 15 or more employees.

When do employees not receive redundancy pay?

Employees are not eligible to receive redundancy pay on various factors under the NES, which include:

- The employee’s period of continuous service with the employer is less than 12 months;

- The employees are employed for a specific period of time or task, or for any specific duration or season;

- They are working for an employer that employs fewer than 15 employees

- The employment of the employees is terminated due to serious misconduct;

- The employees are casual employees;

- The employees are trainees or apprentices; or

- The employees are eligible to other industry-specific redundancy schemes in a modern award.

Learn more:

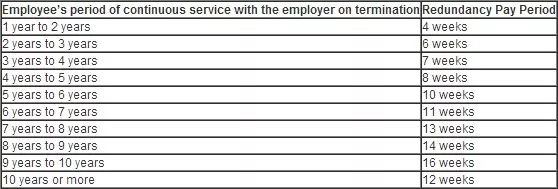

Redundancy Payment Table Australia

How is redundancy calculated in Australia?

The table below provides a guideline in regards to the redundancy pay entitlements of an employee, based on the number of years of continuous service with the employer upon termination.

The amount of redundancy payable to an employee under the NES is determined by using the employee’s base rate of pay for ordinary hours of work. The rate of pay, payable to an employee for ordinary hours of work other than a pieceworker, is known as the employee’s base rate of pay. This does not include:

- Incentive-based payments and bonuses;

- Loadings;

- Other monetary allowances;

- Overtime or penalty rates; and

- Any other separately identifiable amount.

For additional information or employment legal advice, please contact our team of experts at Owen Hodge Lawyers. We can assist you with any questions you may have about the legal minimum redundancy payment, Australian redundancy laws, how your unused annual leave affects your termination pay and more.

Employment Law Team

Frequently asked questions

Yes, you can volunteer to be made redundant. In most cases, the employer will offer the employee a financial incentive to do so.

However, before you agree to voluntary redundancy, make sure you speak to an employment lawyer to ensure you understand your rights

There is no law saying that you can’t return to the same company after being made redundant, however depending on the amount of time that has passed, being re-hired means that your job is no longer redundant and may affect your redundancy payment.

No, your job cannot be filled by another person. If this occurs, your employment termination is not a genuine redundancy.